Your Useful Guide To Life Insurance For People Over 50

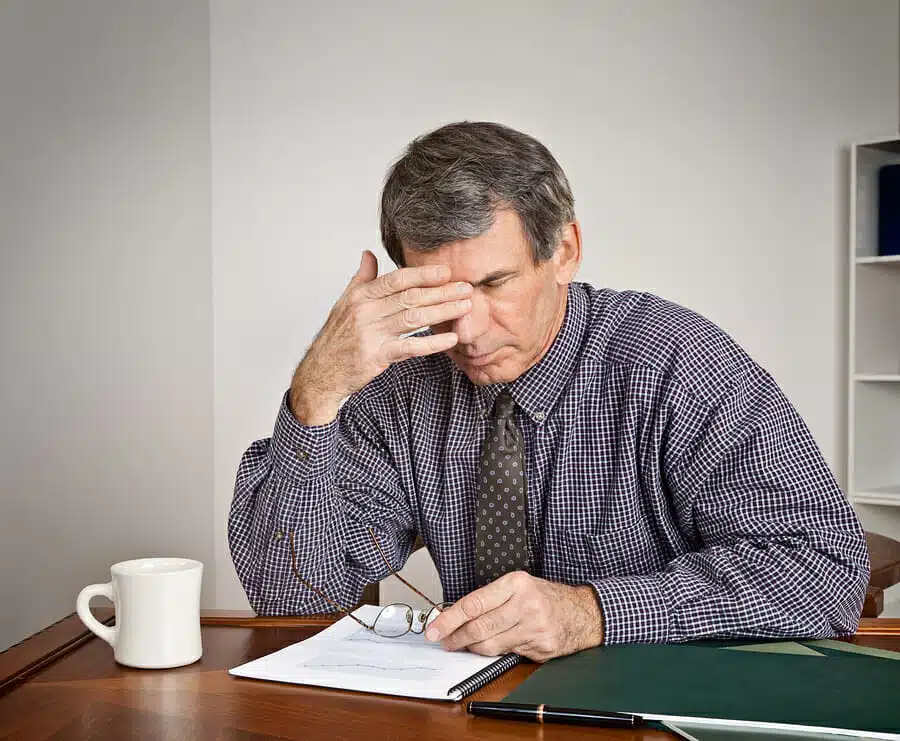

Life Insurance For People over Fifty

Life insurance is something that we often neglect to think about. It’s one of those subjects that is left by the wayside until we become older and more conscious of our need for this sort of cover.

By then it can often be difficult to get hold of sensible, comprehensive coverage.

One of the biggest issues with, for example, over 50s life insurance, is that the premiums go up as a person begins to age.

This often makes it difficult for people to get their hands on packages that they can afford.

Another reason many people struggle to get hold of life insurance after 50 is that many companies don’t accept individuals at this stage of their lives.

Read on If You’re Looking For The Best Life Insurance Over 50

If you’re looking for life insurance after 50, don’t let all this get you down – rest assured, there is almost always a policy that will suit your needs, and you might find it with specialised over 50’s life insurance.

Types of life insurance

The Benefits of Specialized Insurance

One of the biggest benefits of opting for specialized, over 50’s life insurance is that these policies almost guarantee you immediate acceptance, and you often won’t have to pass a medical test or answer specific health questions in order to take advantage of it.

To be accepted by an insurer, you will have to fall within a certain age bracket, and you might be expected to pay a higher premium, but this will depend on the insurer in question.

Another benefit of opting for this sort of cover is that you might be able to take advantage of free cover after a certain age. Sometimes, this age is set at 90, but once you reach that bracket, you will be guaranteed cover without spending a penny.

Lastly, fixed premiums often come with specialized over 50’s life insurance, so you don’t have to worry about your premiums rising as the years go by.

You will usually be expected to pay a certain amount each month and the policy will dictate how much your family gets in the event of your death.

Why you need life insurance coverage over 50

Life insurance is an essential financial tool designed to protect your family’s financial well-being in the event of your untimely death.

It can provide a safety net that helps cover funeral expenses, outstanding debts, and replace lost income.

Choosing the right life insurance policy depends on factors like age, health, financial goals, and family situation.

Get the right insurance policy for your needs

By understanding the different types of life insurance policies available, you can make an informed decision that best suits your needs and those of your loved ones.

Determining whether you need life insurance can be challenging, but it’s important to consider factors such as your financial responsibilities, dependents, and long-term goals.

When choosing a life insurance provider, there are several key factors to consider to ensure you make the best decision for your financial security and peace of mind.

Firstly, research the financial stability and reputation of the insurance company.

A good reference point could be an insurance company like Bennet & Porter Insurance.

Look for providers with strong financial ratings and a history of prompt claims processing to ensure they can fulfill their obligations to you and your beneficiaries.

Secondly, compare policy offerings and premiums from multiple providers to find the most competitive rates and coverage options that align with your needs.

Don’t forget to consider any additional riders or add-ons that may be beneficial for your specific circumstances.

Additionally, seek out customer reviews and testimonials to gauge the level of customer satisfaction with the provider’s services and responsiveness.

Excellent customer service can make a significant difference in your experience when managing your policy or filing a claim.

If you have people who rely on your income or financial support, life insurance is a crucial component of your financial plan. It can provide peace of mind, knowing that your loved ones will be taken care of financially if the unexpected happens.

Additionally, life insurance can serve as a valuable estate planning tool and help cover final expenses, such as funeral costs and outstanding debts.

Term life insurance

is a popular and affordable type of life insurance that provides coverage for a specified term, usually 10, 20, or 30 years. If the policyholder passes away during the term, the beneficiaries receive a death benefit.

This type of policy is ideal for those who need coverage for a specific time frame, such as while raising a family or paying off a mortgage. Term life insurance premiums are generally lower than those for permanent life insurance, making it an attractive option for many individuals.

Frequently asked questions about life insurance

Are there Life insurances for over 50s with free gifts?

Yes, there are life insurances for over 50s with free gifts. Many insurance companies offer such policies, and customers can avail themselves of varying freebies depending on their chosen plan.

The offers may include gift cards, vouchers, or discounts on other products and services.

These free gifts provide added value to the policyholder while providing financial security to them and their families in case of an unforeseen eventuality.

It is important to compare different plans before selecting a provider that matches your requirements for coverage and bonus offers.

What’s the best life insurance for over 50?

The best life insurance policy for individuals above 50 years depends on several factors such as budget, coverage amount, and personal preferences. Many companies offer a range of options designed primarily for people over 50 to address their unique needs such as funeral expenses, outstanding debts or mortgages.

Whole life policies are often preferred by those looking for long-term insurance protection and cash value accumulation through investment portfolios.

Term life policies provide a fixed-rate premium during the term selected ranging from between five to thirty years but don’t accrue any cash-value or return on investment in contrast to whole-life policies.

What Is Whole life insurance for seniors over 50?

Whole life insurance is a type of permanent policy that provides lifelong coverage for the policyholder.

It differs from term life insurance because it doesn’t expire after a specific period, and has an investment component built into it that accumulates cash-value over time.

Seniors over 50 years old can purchase whole life policies to secure their financial future while providing them with added savings account options at higher interest rates than traditional savings accounts.

These plans have flexible premium payments options which make them less prohibitive for older buyers who may not want to lock themselves into long-term contracts with fixed payment obligations.

Does life insurance go up at 50?

Premiums for life insurance typically tend to progressively increase with age, including at the 50-year mark.

This is because older individuals are considered higher risks by insurers due to their increased probability of requiring policy payouts compared to younger policyholders.

Other factors that can affect the price include any history of medical conditions or lifestyle choices such as smoking and alcohol consumption which may also increase premiums for some seniors over 50 when shopping for coverage.

However, it is important to compare policies from different providers before purchasing one that best fits your needs and budget at upper age limits like 50 years old.

How can I avoid paying too much for life insurance?

There are several ways to avoid paying too much for life insurance.

Firstly, it is essential to shop around and compare rates from different providers before signing up for a policy. Many brokers offer free quotes online or over the phone which enable customers to assess plans that best suit their needs and budget requirements.

It is also important to take care of one’s health by maintaining an active lifestyle, healthy diet which can help reduce premiums at application time since insurance companies may adjust rates based on your health history and current status.

Additionally, avoiding high-risk behaviors such as smoking or extreme sports can minimize premium amounts substantially in some cases.

A Summary Of Life insurance For Over 50 People

Life insurance for the over 50s is an essential consideration for those looking to secure their family’s financial future. As people reach 50 years old, their insurance needs may change, and finding the best life insurance options becomes crucial.

There are several types of life insurance policies available for people aged 50 or older, including term life insurance, whole life insurance, and universal life insurance.

Term life insurance is a popular choice for many life insurance policyholders, offering coverage for a specific period, such as a 20-year or 30-year term.

Term life insurance rates are generally more affordable than permanent life insurance options, making it an attractive choice for individuals over 50 and looking for inexpensive life insurance.

However, it’s essential to compare life insurance quotes from various providers to find the best policy for your needs.

Best life insurance for people Over 50

Whole life insurance policies offer permanent insurance coverage, with both a death benefit and a cash value component.

This type of policy may be more expensive than term life insurance, but it can provide lifelong coverage and potentially serve as an investment vehicle. For applicants over age 50, a whole life policy can be a valuable financial tool for estate planning and wealth preservation.

Universal life insurance is another type of permanent life insurance, offering flexibility in premium payments and the potential for cash value growth. A universal life policy can be tailored to meet specific life insurance needs, making it a suitable option for individuals 50 or older who want a more customized insurance product.

It’s essential to consider that life insurance for seniors may come with higher premiums, as insurance companies perceive a higher risk associated with older policyholders. However, affordable life insurance over 50 is still possible, especially when exploring term life insurance options and comparing quotes from various providers.

One crucial factor to consider when shopping for life insurance is whether a medical exam is required. Some insurance products, such as guaranteed issue life insurance or final expense insurance, do not require a medical exam, making them a more accessible option for those with health concerns.

When evaluating life insurance companies for people over 50, it’s essential to research the best life insurance companies and their offerings.

Life insurance providers for people over 50

Companies like Pacific Life, Protective Life, and Mutual Life Insurance offer a range of insurance products tailored to the needs of individuals later in life.

As you assess your insurance needs, it’s essential to determine how much life insurance coverage you require, considering factors such as outstanding debts, funeral expenses, and the financial support of your loved ones. This helps you determine the best life products when it comes to wanting life insurance.

Working with a reputable insurance provider can help you navigate the various insurance options and find the best policy for your specific needs.

In conclusion, life insurance for the over 50s is a crucial aspect of financial planning, providing security and peace of mind for both the policyholder and their loved ones.

By researching and comparing the different types of life insurance policies and providers available, individuals over 50 can secure the best life insurance coverage and protect their family’s financial future.

Learn about the possibilities of securing life insurance without undergoing a medical examination and explore tailored insurance options for individuals over 50. Discover the benefits and requirements of over 50s life insurance in this comprehensive guide on LifeOver50.”

This article does not provide financial advice. It is simply a general guide to life insurance. If you are considering taking out a life insurance policy, then make sure you talk to a qualified financial advisor.